Discover the Ucosystem

A dynamic technology ecosystem of businesses, services, apps, and smart-contracts facilitating turbocharged B2B/B2C user interactions, innovations and engagement.

All powered by U.ONLine and UCASH, the network access token of the Ucosystem.

Explore the Ucosystem

View U.ONLine

Blockchain Integration

Harness the power of blockchain for secure and transparent transactions within the ecosystem.

Ucosystem Businesses

Dozens of businesses powered by the U.CASH network token, creating a robust and interconnected ecosystem.

Smart Contracts

Automate and streamline processes with smart contracts for efficient and reliable interactions.

Innovative Apps

Access a wide range of apps designed to enhance user and business interactions within the ecosystem.

Security & Privacy

Top-notch security measures ensuring your data and transactions are safe and private.

Efficient Performance

Optimized processes and interactions for fast and reliable performance across the ecosystem.

UCASH Wallet

Manage your tokens and interact seamlessly with the ecosystem using the UCASH wallet.

Token Economy

Participate in a thriving token economy that powers transactions and services within the Ucosystem.

Comprehensive Documentation

Extensive resources and guides to help you navigate and utilize the U.CASH ecosystem effectively.

U.CASH: Innovative Decentralized Commerce and Finance

Built with innovation & security in mind. U.CASH is your gateway to a decentralized financial ecosystem.

Users onboarded

On-chain holders

Ucosystem Businesses

Ucosystem Daily Visitors

The innovative Ucosystem

Explore the cutting-edge solutions offered by U.CASH to revolutionize your financial and business interactions.

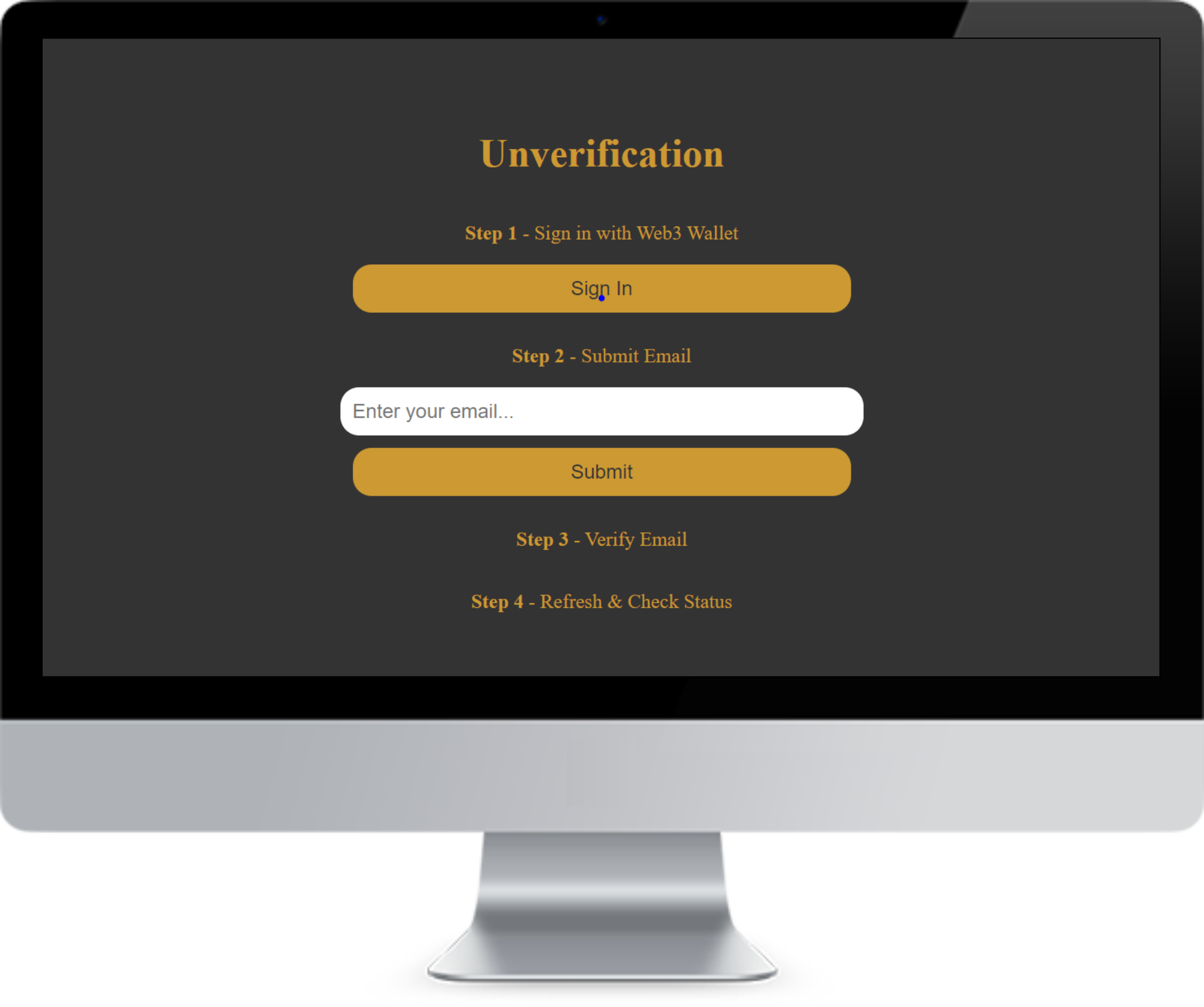

Unverification dApp

Securely Verify Your UCASH Wallet for Premium Access.The Unverification dApp offers a seamless and secure verification process for your UCASH wallet. Unlock premium features and gain enhanced access to Ucosystem apps by verifying your wallet with ease and confidence.

Start UnverificationWhat is UCASH

UCASH is the network access token of the Ucosystem, enabling advanced functionalities, rewards/loyalty premium services, payment and smart-contract capabilities, and innovative business solutions.

Read MoreU.ONLine Info

U.ONLine is the decentralized protocol where UCASH is the native asset, enabling truly decentralized business interactions, data management, smart-contract functionality, financial services, and much more.

Read MoreThe Ucosystem

The Ucosystem comprises services, applications, blockchain technology, dApps, smart contracts, and business/retail commercial capabilities, all empowered by seamless integration with U.ONLine and UCASH.

Read More